Read, Watch, Listen

Listen: Tennessee High Schoolers Solved a Nearly 40-Year-Old Serial Murder Mystery

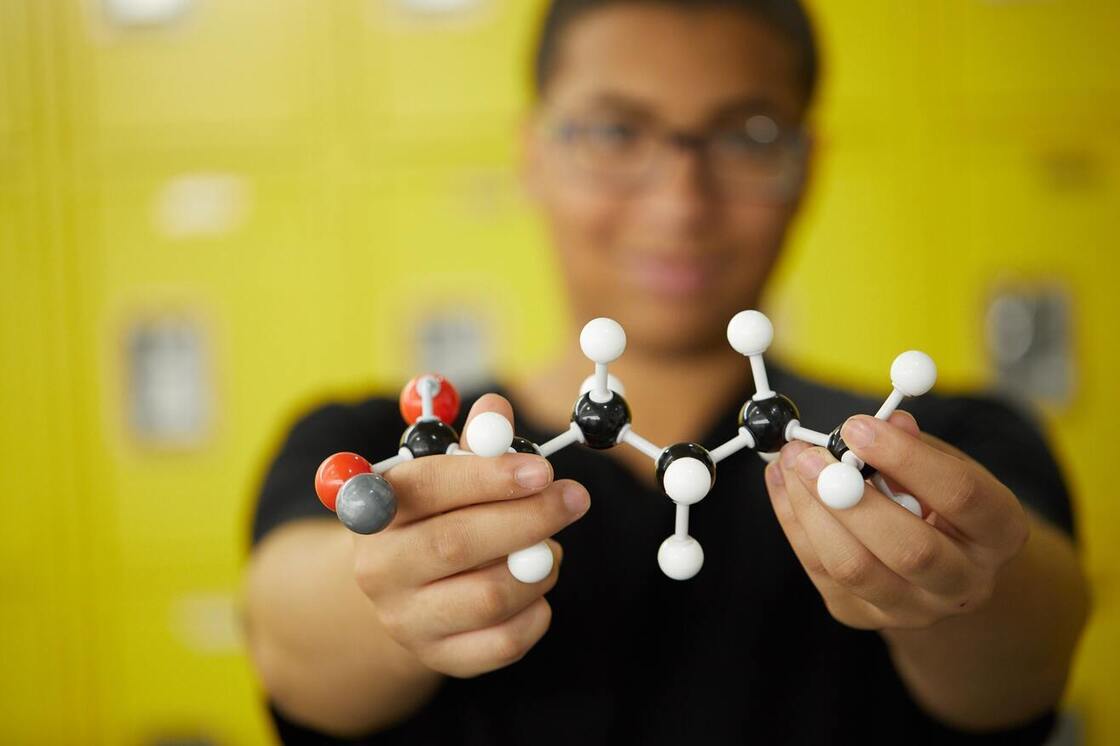

Watch: New Film Inspires America to Rethink High School

Watch: Rethinking High School in the DC Public Schools

7 Artificial Intelligence Trends That Could Reshape Education in 2024

How D.C. Successfully Redesigned a School By Embracing Its Legacy

Michigan Teens, Schooled in an Old Museum Without Classrooms, Eclipse Status Quo

After I Got Shot, My School Did Nothing to Save Me From…

I Changed My Shoes, and It Revolutionized How I Was Able to…

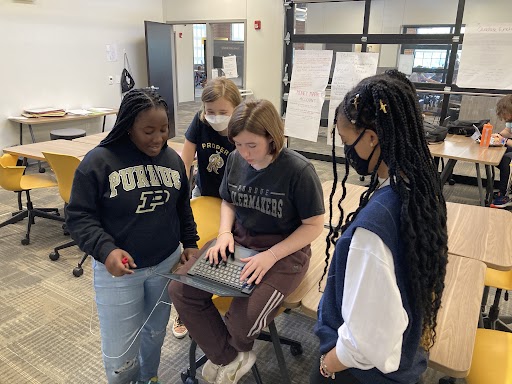

Rethinking High School: Upending Traditional Subject Structure in Indiana

It Starts with You + XQ

Learn more About Us—see Where We Work, view our Resources and Tools, and read our Insights to begin the work of high school transformation.