What is Financial Literacy? (And Why Does it Matters for Your Students?)

Learn how to get your finances in order with these well-explained financial basics.

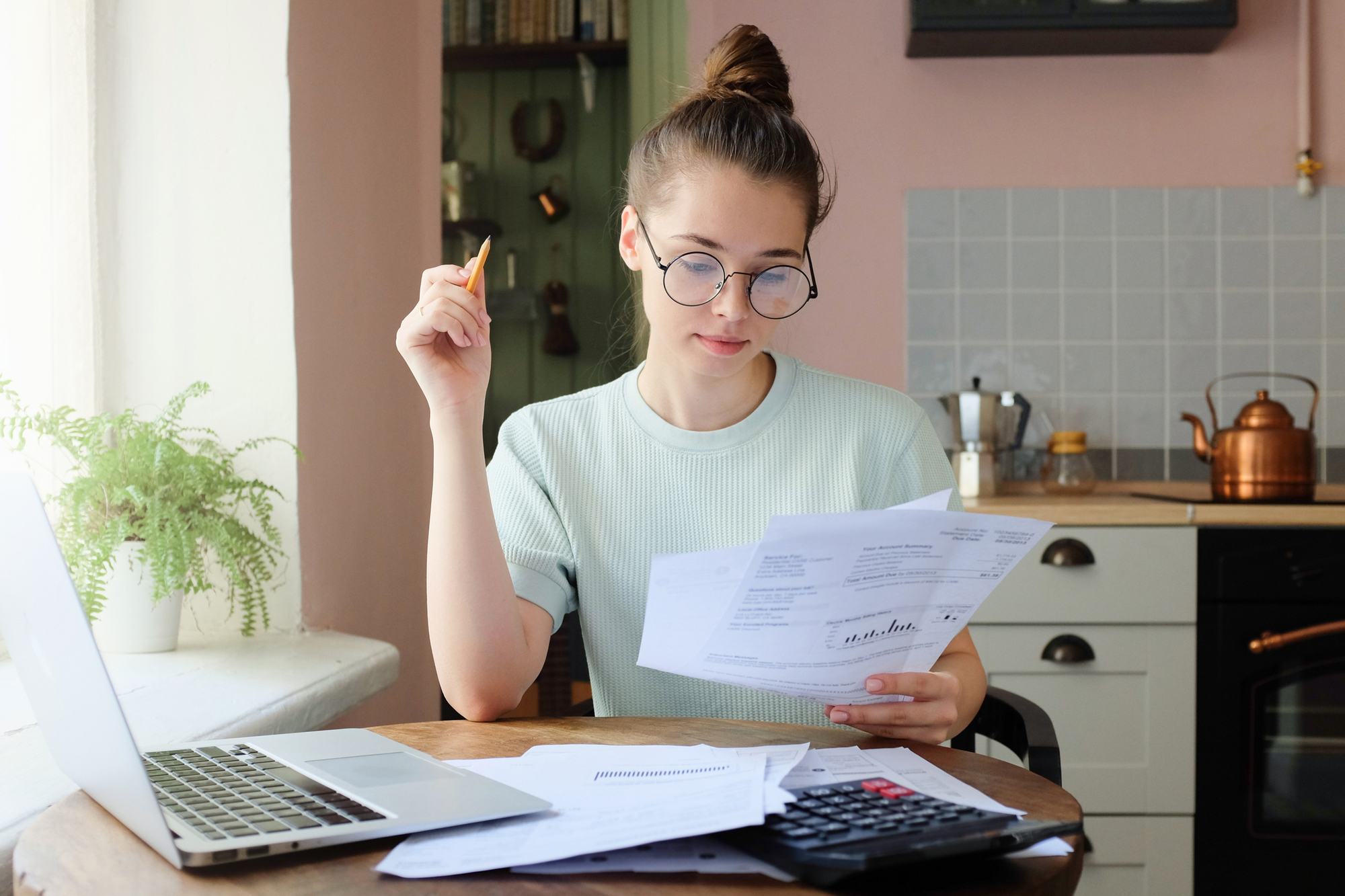

Dealing with personal finances is an important step on the path to adulthood. Anyone who has had to make a budget or pay a bill knows that financial literacy is an important life skill, and yet so many high school students graduate without the knowledge needed to make smart personal financial choices.

Many of today’s students see themselves as future entrepreneurs. In a recent survey by WorkPlace Intelligence, nearly three-quarters of high school students said they hoped to one day start their own business. In order to make that dream a reality, students need the opportunity to become as skilled in financial literacy as in any other academic subject.

Whether it’s launching a new business venture or simply figuring out what to do with their first paycheck, money comes with a lot of responsibilities and considerations including how to manage and budget, file taxes, build credit, and much more. However, educators should not fret, there are lots of reasons to teach financial literacy and tons of ways to incorporate financial literacy curriculum into their lessons plans.

What is Financial Literacy?

The President’s Advisory Council on Financial Literacy defines personal financial literacy as “the ability to use knowledge and skills to manage financial resources effectively for a lifetime of financial well-being.”

It’s important for students to be empowered with the knowledge of how to earn, save, borrow, and protect their finances. However, there are few resources for educators to use to help students understand that’s why XQ created a set of activities to get students started on the journey to financial success by earning their Financial Literacy Badge.

Educators can use these sessions to help students learn about:

- Getting paid and paying taxes

- Saving and growing money

- Borrowing money, including debt, credit cards, and loans

- Protecting money through investing

Of course, in today’s complex world, financial literacy doesn’t end with personal finances. Issues like global economics, entrepreneurship, and new forms of investing must also be part of the curriculum. And since most transactions occur online, knowing how to use real-time technology is also a must.

Why is Financial Literacy Important for Students?

For the majority of adults, finances are a source of great stress. 73 percent of Americans rank their finances as the number one stress in their life. That number is even higher for younger generations.

Research shows that many habits related to managing finances, from planning ahead and budgeting to delayed gratification, are set as early as age seven. One study out of BYU found that those who learned financial literacy in their youth had healthier personal relationships in adulthood.

A lack of financial literacy can lead to devastating consequences, from crushing credit card debt and burdensome student loans to being unable to buy a home or car and not saving enough for retirement. That lack of financial acumen is one of the reasons why today 78 percent of adults live paycheck to paycheck.

Yet despite the importance of learning financial literacy at a young age, more than one in six students in the U.S. do not reach a baseline level of proficiency, and less than half of states make personal finance courses a requirement for graduation. The problem is even worse for students from low-income backgrounds.

How Educators Can Advocate for Equitable Access to Financial Literacy

Students from low-income backgrounds are often the most in need of financial literacy education but the least likely to get it. In a report from Next Gen Personal Finance, the group found that at schools with at least 75 percent of students eligible for free or reduced-price lunch only 3.9 percent of students were required to take a course on personal finance.

For teachers, you can advocate for equitable access to financial literacy skills by:

- Encouraging your school to make financial literacy courses required for all students. Even incorporating personal finance as a larger part of a math or economics course is better than nothing.

- Expanding financial literacy education beyond just a one-semester course. Just like in math where you build on past topics, financial literacy should be a cumulative process.

- Connecting financial literacy with social-justice issues. There is a long history in the United States for communities of color between finances and inequality, from discriminatory lending practices to redlining, and understanding those policies can better equip students to face the future.

- Partnering with outside organizations for real-world learning experiences. Local financial institutions can be great resources for bringing their expertise into the classroom. The University of Pennsylvania’s Wharton School also recently launched a program to teach personal finance to disadvantaged students.

Four Approaches Financial Literacy Education to Replicate

At XQ, one of the big questions driving high school transformation is what do young people need from their schools today to help them succeed in the future? It’s clear that financial literacy skills are crucial for students to face the challenges of the 21st century.

Throughout the country, our partner schools are finding unique ways to integrate financial literacy into their curriculum. Here are four examples to replicate in your classroom:

- At Elizabethton High School in rural Tennessee, students can take a course in entrepreneurship, where they have the chance to work with their community to raise funds and launch their own business ventures.

- At Iowa BIG in Cedar Rapids, students regularly work with local partners, collaborate with business owners and nonprofit leaders, and gain valuable lifelong skills, like grant writing and budgeting.

- At Ponaganset High School in Rhode Island, students have the opportunity to prepare for the future of their choosing and engage in electives in and out of school, like one student who completed a financial literacy course at a local college.

- And at Tiger Ventures in Endicott, New York—the birthplace of IBM—students work literally side-by-side with local entrepreneurs. The school is located in a building with a publicly supported business incubator, and students frequently engage in deep discussions about socio-economic justice.

Despite the historic lack of financial literacy as a major component of American education, that’s changing. Florida recently became the largest state to mandate personal finance education in high school, and rising concerns over student debt and rising inflation have brought into focus the need to make personal money skills a priority for high school students.

Financial Topics to Add to Your Financial Literacy Curriculum

Communicating the nitty-gritty of financial literacy isn’t easy, but there are many ways educators can provide students with the skills and confidence to achieve personal financial goals. Here are some big topics with which to start.

Budgeting

Creating a budget is an important first step for students to begin thinking about their future. These skills will help students prepare to manage monthly expenses, save for emergencies, and set goals for their future, from buying a car to paying for college.

It can also be helpful to have students think about others and walk in someone else’s (financial) shoes. Working in small groups, have students think about how much an average person spends in a week, and then assign them different circumstances, from being single or married with children to paying off student debt. This activity not only teaches financial literacy but empathy as well.

There are also a number of resources, from online games to financial literacy curriculum, for teachers to bring lessons on budgeting into the classroom. Common Sense Education also offers lesson plans on budgeting to get you started.

Taxes

Receiving the first paycheck can be a monumental experience for students, but that excitement is quickly tempered by the reality of taxes. It’s important to teach students about why the government collects taxes and the types of public services that money keeps running, from the Post Office to Social Security.

Although most high school students will not have to file taxes, they most likely will in a few years. Teaching them about concepts like withholdings, deductions, and how to file taxes will make sure they aren’t caught off guard at the start of their first job. The IRS has a number of resources to help explain the hows and whys of taxes.

Student Loans

For most students, attending college will require some form of financial aid. But making such a big decision as a senior in high school can have far-reaching consequences. In the United States, 43.4 million borrowers have federal student loan debt with an average balance of more than $37,000.

And if you think students will learn about these issues at home, think again. A 2017 T. Rowe Price survey found that 69 percent of parents were uncomfortable talking to their kids about finances. From helping students understand the different types of student loans available to them to navigating the variety of state, college, and nonprofit grants and scholarships students can apply for, teachers can make student loans a teachable moment and help set their students up for success before they even graduate.

Going Beyond Dollars and Cents

Of course, these are just a few of the basic topics to introduce to your students. There are numerous other topics your students might be interested in, from figuring out the stock market to unpacking cryptocurrencies.

Creating a strong financial literacy curriculum should also include topics like:

- Entrepreneurship and marketing

- Global economies

- Personal finance technology

- Investment strategies

Learn more about how to talk to your students about finances with Financial Literacy 5 Ways.

Learn More about Financial Literacy for Students

Want to learn more about bringing financial literacy into your classroom? There are lots more resources to explore, including:

- Lesson Ideas for High School Financial Literacy from Edutopia

- Resources for Teaching Financial Literacy from the National Education Association

- Teen Financial Literacy from the American Library Association

Sign up for Give Me Five, our biweekly newsletter for educators ready to rethink high school and get 5 hand-picked resources every two weeks to #ReThinkHighSchool